In 2023, the price center of the stainless steel wire market continued to shift downwards. Under the influence of price trends in raw materials such as nickel iron and molybdenum iron, wire prices have been falling along the way. The most significant decline was in February March, and transactions gradually rebounded from April May due to peak season expectations. However, traders were relatively cautious in restocking. During this period, market destocking accelerated, steel plant production gradually recovered and increased, and a slight rebound was triggered by the dual prosperity of supply and demand. From June to July, prices fell again due to the suppression of off-season expectations and the release of peak season demand. However, the decline slowed down compared to February March, and the overall price fluctuation was weak. From August to September, downstream purchasing attitudes rebounded slightly. Downstream demand is replenished in stages. After entering the fourth quarter of the downturn, policy efforts continue to increase, and under changes in the international macro situation, the resistance of wire rods to decline has strengthened. Although related varieties have weakened, But at this stage, prices are relatively stable and firm. Looking ahead to 2024, how will the price of stainless steel wire be interpreted?

1、 Review of the 2023 Wire Market

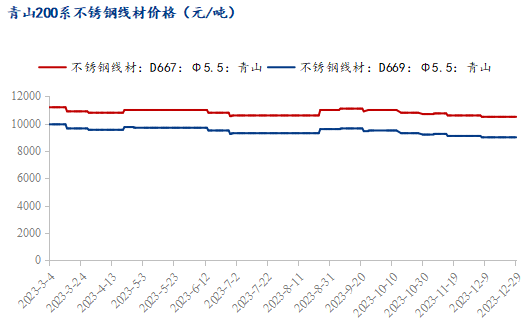

200 Series: Looking back at the price trend throughout the year, D667 material prices have been continuously falling since mid March 2023. From mid May to mid June, prices have remained stable, and after falling to the lowest price of 10550 yuan/ton on June 25th, they have entered a stable wait-and-see state. In the first half of the year, the cumulative decline was 650 yuan/ton. From mid August, prices have been narrowly raised, reaching a maximum of 11100 yuan/ton. Prices began to decline at the end of September, gradually maintaining stability by the end of the year. D669 material has maintained the same trend of rise and fall as D667. The average price of D667 material in 2023 was 10807 yuan/ton, while the average price of D669 material was 9440 yuan/ton, indicating a relatively stable price trend throughout the year.

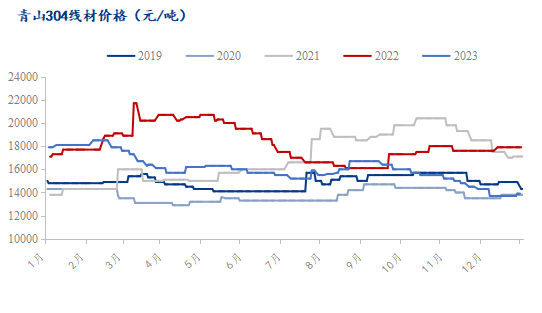

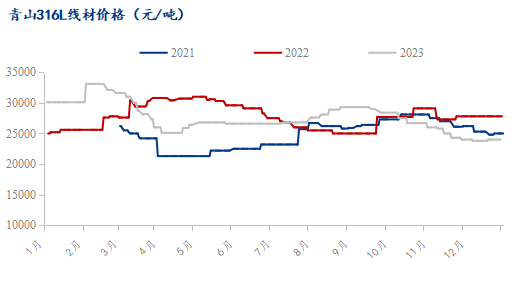

In terms of 300 series

300 Series: Looking back at the price trend throughout the year, the price of 304 material showed a slow upward trend from January to late February 2023, and rose to the highest price of 18500 yuan/ton on February 5. Afterwards, the price continued to decline, dropping to the lowest price of 13700 yuan/ton on December 6. From August to September, it initially showed a strong and then weak trend, and entered a complete downward trend in mid September. The price trend of 316L material is similar to that of 304 material, rising to the highest price of 33100 yuan/ton on February 3 and falling to the lowest price of 23800 yuan/ton on December 7. Compared to other varieties related to stainless steel, the overall decline in wire prices is relatively slow, completely different from the price trend in the first half of 2022. Specifically, in the first half of 2023, the average price of 304 material was 16040 yuan/ton, a year-on-year decrease of 11.8%, and the average price of 316L material was 27500 yuan/ton, a year-on-year decrease of 0.8%. Compared with the same period last year, wire prices are at a low level this year.

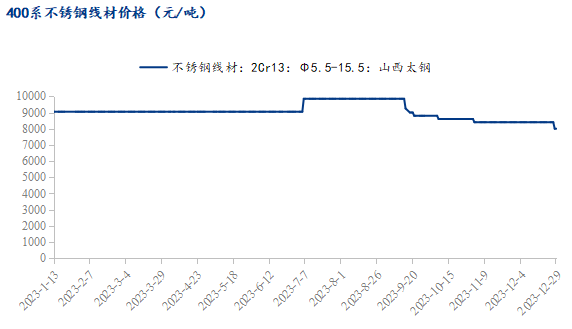

In terms of the 400 series

400 Series: Looking back at the price trend throughout the year, taking Shanxi Taigang as an example, the price of 2Cr13 material remained stable from January to July 2023. After a brief increase from mid July to mid to late September, the price remained stable and rose to the highest price of 9850 yuan/ton on July 6. After mid September, the price continued to decline and fell to the lowest price of 8400 yuan/ton on November 2. The overall price trend remained stable throughout the year, with an average price of 9060 yuan/ton.

2、 Review of Wire Production in 2023

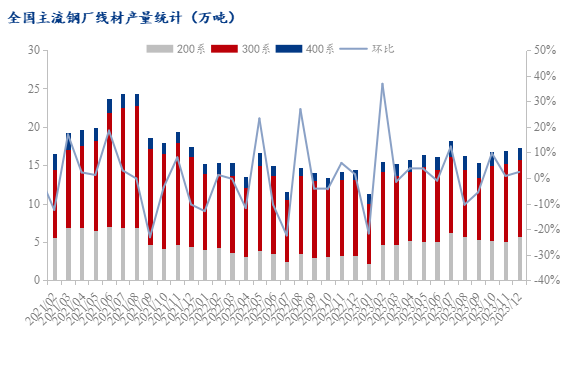

According to Mysteel statistics, the total production of stainless steel wire in 2023 was 1.9121 million tons, a year-on-year increase of 22.1%. Among them, the total production of the 200 series was 598200 tons, a year-on-year increase of 61.5%; The production of 300 series reached 1.1149 million tons, a year-on-year increase of 4.3%; The production of the 400 series reached 199000 tons, a year-on-year increase of 41.1%, mainly reflected in the 200 series and 400 series. The 200 series market has strong resistance to decline this year, and the profit margins of steel mills and traders are still acceptable. Driven by profit, the production schedule of steel mills is inclined towards the 200 series and 400 series, with a more obvious inclination of molten iron.

3、 Outlook on the price trend of wire rods in 2024

Looking back at the price trend of stainless steel wire in 2023, the demand has been at its peak throughout the year, with a significant decline in demand from intermediate processing and trade enterprises. New steel rolling enterprises that have been put into operation for the year have not yet conducted comprehensive mass production. In terms of production, some steel mills have increased their annual production, but the return of Indonesian billets has decreased, mainly reflected in the 300 series. The production of the 200 series and 400 series has shown a certain increase, while the increase in production of the 300 series is relatively small. In terms of annual prices, the 200 series is relatively resistant to decline, and demand is stable and released. At present, emotionally, steel mills remain cautious in their operations, traders replenish as needed, and deep processing and drawing enterprises still maintain a relatively high level of inventory. Raw material production capacity is expected to increase next year, and with limited support from all parties in the market, the rebound of wire rods is relatively weak. Domestic policies will continue to remain loose next year, and there will still be disturbances in the international situation. The price game of nickel iron and plate coils also limits the fluctuation space of wire rods, and it is expected that the price of stainless steel wire rods will be weak in 2024.

This article is reprinted on Mysteel